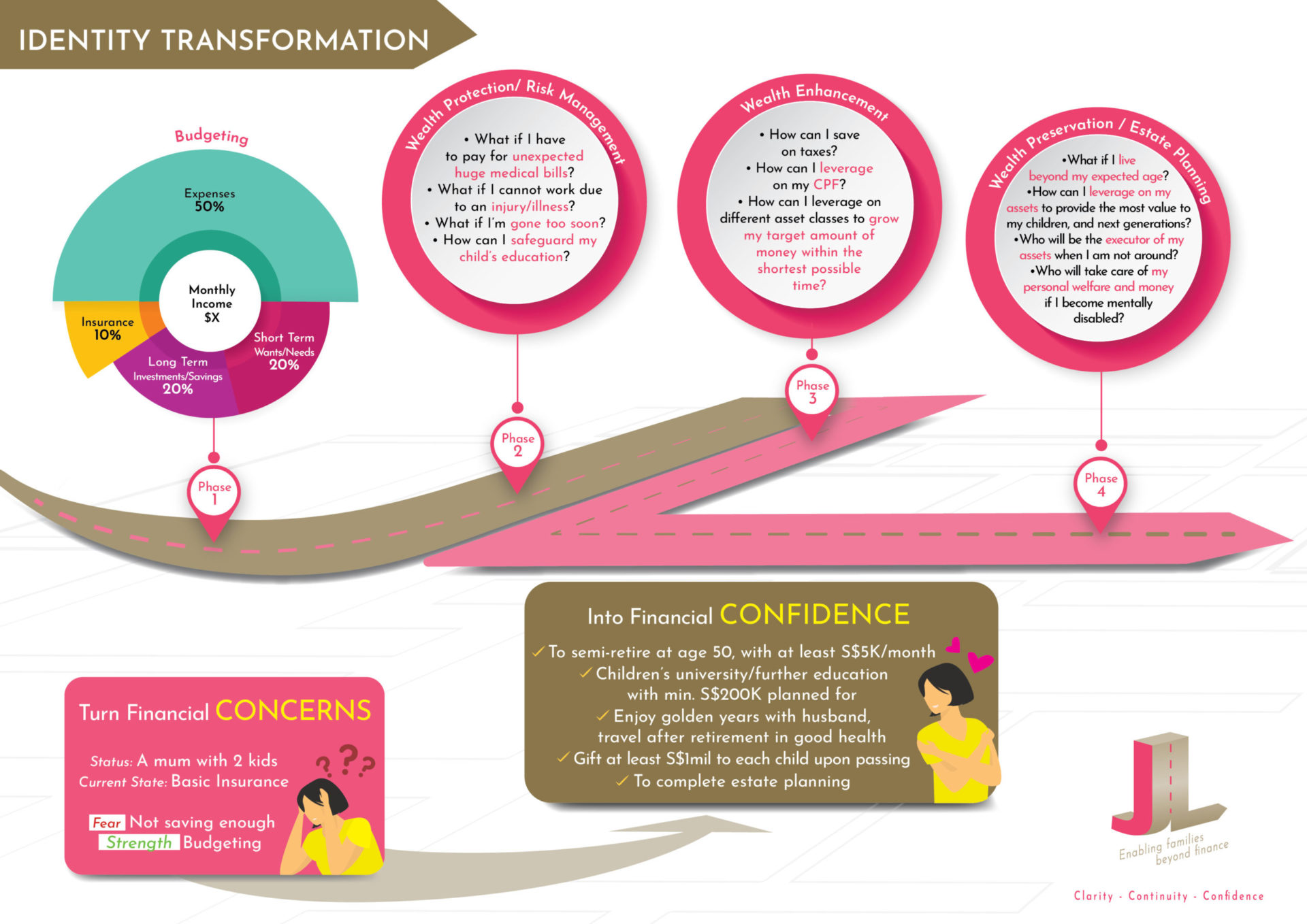

These days, more mothers are embracing financial planning for mothers to secure their family’s future. Whether it’s managing everyday expenses, saving for children’s education, or preparing for unexpected situations, mums are taking charge of their financial well-being. By focusing on self-care and future financial goals, they’re ensuring both their own and their family’s long-term stability and happiness.

Why are more mums starting to be more proactive about their finances now?

- Uncertainty in jobs e.g., companies are cutting costs, some are axing staff too.

- Evolving work arrangements e.g., work from home (WFH), alternating work from home with office, no caregivers to help etc.

- Struggle with childcare support e.g., increasing childcare expenses, expenses needed to hire a good helper.

- Increase in stress and lack of communication with spouse e.g., husband and wives are worried about their careers, the inflation that’s hit Singapore with increasing prices for many things, lesser face-to-face time with each other to nurture the marriage, more possible friction.

- Worried about the opportunities they can provide their children with e.g., enrichment classes, travel overseas.

- Concerned about the future funds their children will need e.g., tertiary education school fees, possible medical bills.

- Realised that they will need backup funds for their aged parents’ future medical expenses.

- Wonder when they can retire comfortably and if they can afford to stop working at all or not rely on their husbands.

- Feel a sense of self-neglect as they don’t seem to have much money left for their current needs e.g., buying skincare for themselves, shopping for clothes, enjoying a nicer meal or even treats like facial and massage sessions.

Mums often take on the “giving” role, looking after the needs of everyone in the family, yet often neglect herself. This self-awareness becomes more apparent these days, and mummies want to take charge of their finances and care about their own wellbeing too. They know that they must make plans for themselves, otherwise, it’s likely that no one else would.

Of course, there are exceptions for some spouses, where the husbands would take on the Chief Financial Officer (CFO) role in the family and ensure that their wives need not have to worry about money matters.

Be prudent savers

In general, one should be armed with three to six months of their monthly living expenses in emergency funds.

Essentials like eggs, chicken, fruits and ride-hailing are now costlier. Possible to switch to cheaper alternatives?

Is it necessary to send your kids to a premium childcare? Perhaps consider a kindergarten with pocket-friendly school fees. There are childcare subsidies for working mums in Singapore, and the money is helpful in cushioning expenses.

Mums know that accumulated savings can go a long way!

Invest to grow your wealth

One of the ways to tackle inflation is through investments. This way, mums can also work towards a certain goal such as growing the funds to purchase your next home, children’s education costs and your own retirement plans.

That said, everyone’s risk appetite is different. The key is to work with what you are comfortable with as one mum’s investment portfolio can be very different from the other. This may include equities, unit trusts or other investment-linked policies.

Get insured to buffer against unexpected times

For a typical family’s financial planning, coverage includes life, health, wealth accumulation, home, personal accident insurance. If planning an overseas trip, parents will get travel insurance. If the family has hired a Migrant Domestic Worker or helper in their home, employers are required to buy maid insurance too. Pregnant mums usually buy maternity insurance to ensure protection for her unborn baby too.

So, is it possible to be a financially-smart mother without neglecting ourselves? Definitely!

There’s no doubt that financial planning is crucial for women – statistically, we tend to have a longer life expectancy than men too! There are different parental grants, maternity benefits and tax reliefs for families in Singapore too – are you aware of them?

Mums, planning for your future is not rocket science or unattainable at all! I have been working alongside many mummies , supporting their financial journey in a systematic manner. Perhaps, you may want to start checking in on yourself to find out how well you have prepared based on my guide.

Sometimes, it can be mind-blogging to figure everything out on your own. Leave the complexities for me to solve, and the simplicities for you to execute. Be assured with a peace of mind and a sense of financial confidence. From a fellow mummy living and raising kids in Singapore, just like you.