Planning for a family inevitably involves the discussion on financial planning and the costs of having a baby. During the pregnancy journey, more parents nowadays purchased maternity insurance plans to cover unexpected complications for the pregnant mum and the unborn child too.

What are maternity insurance plans?

Parents purchase maternity insurance plans (also known as prenatal or pregnancy insurance) with a one-time premium starting from the 13th week of pregnancy. It may seem similar to a health insurance plan, but a maternity plan offers a basic financial protection for pregnancy complications and/or covers congenital illnesses for the baby. This coverage comes in the form of a lump sum pay-out or daily hospital cash (usually 1% or 2% of sum assured) to offset additional medical costs.

Mums-to-be who are looking to buy pregnancy insurance, do note that some policies come with certain criteria such as pre-existing health or previous pregnancy conditions, and mummy’s age.

It is common for parents to be extra worried about the unborn child and expectant mama’s health. We hope for a smooth-sailing chapter for both, but sometimes things are not within our control. That is how useful having an ideal maternity insurance can be especially when there are medical costs involved. The coverage amount may not be substantial to cover the cost of your delivery or your hospitalisation bills, but it can help to cushion some unforeseen expenses.

Some key coverage to look out for in a maternity insurance

- Coverage on pregnancy complications such as threatened abortion, miscarriage, pre-term labour and pre-term delivery and postpartum haemorrhage requiring Hysterectomy.

- Inclusion of congenital illnesses for the newborn such as Cerebral Palsy, Down’s Syndrome, and congenital deafness.

- Special post-delivery needs like outpatient phototherapy benefit for treatment of severe neonatal jaundice.

What local maternity insurance plans do not cover

- Obstetrics and Gynaecology visits

- Hospitalisation bills

- Delivery fees

- Some policies do not cover mums if your pregnancy was a result of in-vitro fertilisation (IVF) or other assisted reproductive technology.

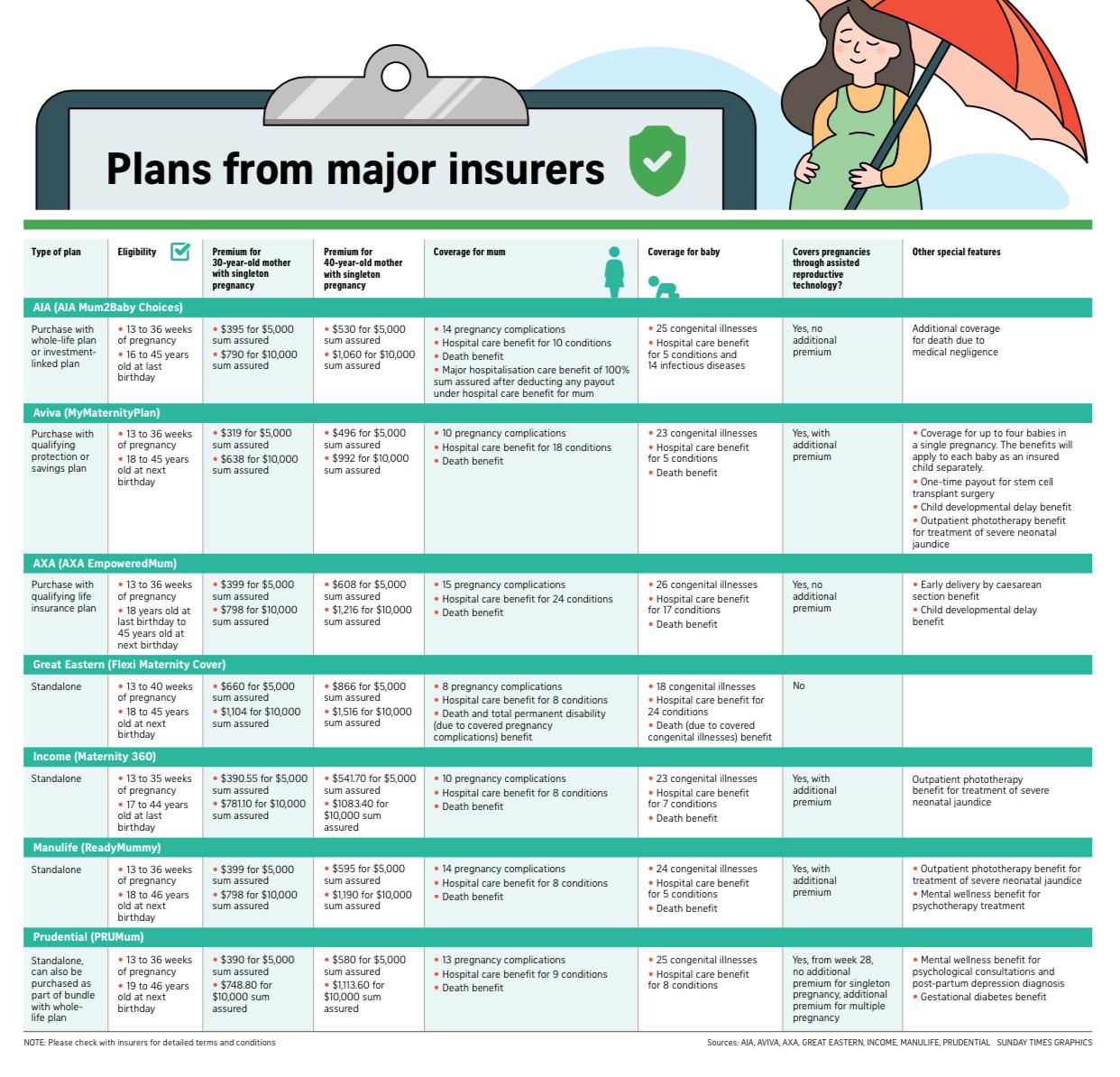

For a quick overview, this maternity insurance comparison chart shows the different policies in Singapore offered by major insurers. Plans include: AIA Mum2Baby Choices, Aviva MyMaternityPlan, AXA EmpoweredMum, Great Eastern Flexi Maternity Cover, Income Maternity 360, Manulife ReadyMum and Prudential PRUMum.

How do parents decide which is the best maternity plan to buy?

This is a common question I get from many new parents because the uncertainty of things makes it extra anxious for them to want to get the best maternity insurance plan and coverage. Rationally, there are many factors to consider including the new mum’s health, baby’s health risk and whether you prefer a standalone plan or have it attached to a traditional life/investment-linked plan.

In short, consider your needs before committing to a policy, and buy it as soon as you are eligible to protect against any complications.

Jenelle’s financial tips: Take note of what you are paying for, as only certain components of the maternity plan will pay out the full sum assured when claimed. For example, the hospital care benefit may pay out only 1% of the sum assured per day, for up to 30 days.

My personal preference as a pregnant mum is towards a bundled plan, which can be transferred to the baby within a certain period, with no medical underwriting. The main concern I have during my pregnancy is to guarantee my baby’s insurability. This means the baby will be covered even if he or she is born with congenital conditions or birth defects.

Just like hiring a confinement nanny and deciding which confinement myths to follow (or not!), there may be many consideration factors for you and your spouse to discuss before getting a pregnancy policy.

Also, look out for specific points depending on what applies for example: covering pregnancies including those after undergoing IVF or other assisted reproductive technology. Remember to check the policy terms and conditions if you need the plans to cover multiple babies in a single pregnancy, even for IVF cases. Some dads are also concerned about their partner’s post-pregnancy wellness and want the coverage to include Major Depressive Disorder (MDD) and other mental health illnesses – this is another point to ask your insurance planner about.

It would be ideal for you to have a professional consultation with a financial planner before getting a new insurance plan. Are you ready to plan your parenthood journey? I’m just a phone call or text away to share my knowledge and experience as a mother and financial advisor – feel free to contact me for a complimentary consultation.