If you’re part of the Sandwich Generation, you know the weight of responsibility of caring for aging parents while raising young children—all while trying to build our own financial future. With the rising cost of living in Singapore, longer life expectancies, and the need to stretch our retirement savings, financial pressure has never been higher.

The Urgent Need to Earn at Least 4% p.a. to Outpace Inflation

With inflation rising, simply cutting costs isn’t enough. It’s more important than ever to grow our savings sustainably.

- How can we secure at least 4% per annum in returns?

- Where should we allocate savings to ensure long-term financial stability?

- What options provide growth without excessive risk?

If these questions feel overwhelming, you’re not alone. Many Singaporeans are now re-evaluating their financial plans, especially with rising costs, longer life expectancies, and shifting CPF policies.

The key to long-term financial confidence? It’s not just reacting to changes, but planning ahead to stay ahead.

Relying on Short-Term Relief Isn’t Enough

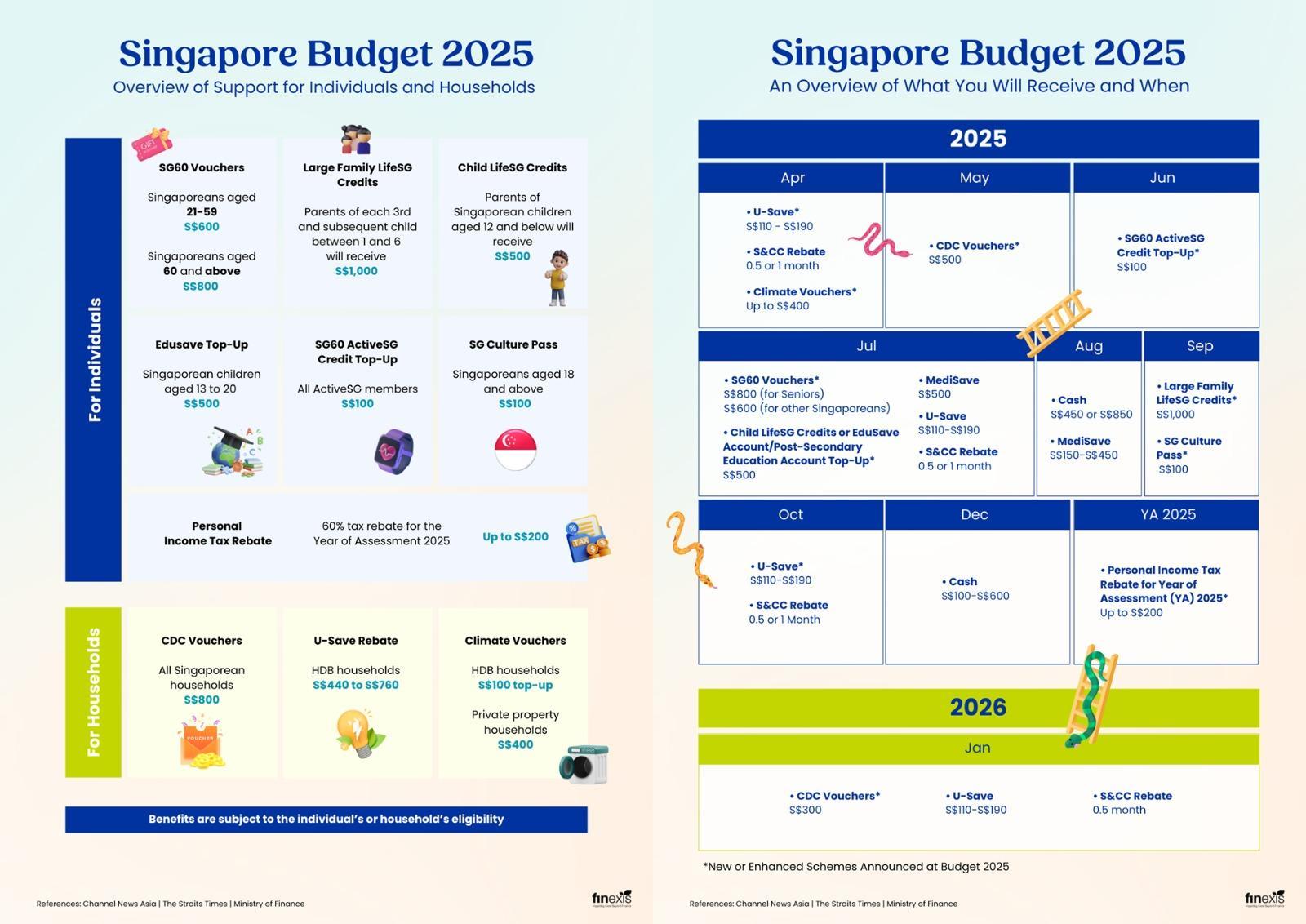

With Singapore Budget 2025 introducing incentives to help ease financial burdens, many Singaporeans feel these measures provide only temporary reliefs. (Caption for the picture)

Singapore Budget 2025: What Matters Most to Families?

We recently conducted a poll to understand which benefits from the Budget 2025 resonate most with families. Here’s what stood out:

- Cash & Household Support Matters Most – Child LifeSG Credits (S$500) and CDC Vouchers (S$800) were top picks! The Child LifeSG Credits (for children born between 2013 to 2024) will be disbursed in July 2025, while credits for children born in 2025 will arrive in April 2026. These can be used for daily essentials at merchants that accept PayNow or NETS payments.

- Financial aid is preferred over lifestyle perks – Many parents prioritize direct cash or credit support over perks like the SG Culture Pass or Edusave Top-Ups. While valuable, these do not directly ease household financial burdens. (Do you know what the SG Culture Pass can be used for?)

- Less Interest in Niche Benefits – Larger family incentives and cultural experiences received low engagement, implying they may not be relevant to most households.

The real question remains:

How can families like ours stay financially secure in an economy where costs keep rising?

Beyond Temporary Relief: Addressing Real Financial Pressures with Practical Actions

While Budget incentives offer short-term relief, long-term financial security depends on the choices you make today.

- Short-Term Support Helps, But Long-Term Stability is Key

Government payouts provide temporary relief, but they aren’t a long-term plan.

📌 What You Can Do: Start Planning for Retirement

Instead of relying on periodic payouts, a consistent approach to saving ensures stability for the future.

✔ Continue contributing to CPF, SRS, or personal retirement plans—even during financially tight periods.

✔ Automate monthly contributions—even S$50 per month compounds over time.

✔ Reassess your financial goals regularly to stay on track for retirement.

- Rising Costs in Childcare, Student Care & Household Expenses

Despite subsidies, the cost of hiring a helper, sending kids to student care, or managing daily essentials adds up fast

📌 What You Can Do: Maximize Available Resources

Many support schemes exist, yet families often don’t fully utilize them.

✔ Explore tax reliefs, caregiver grants, and childcare subsidies that can lighten financial pressure.

✔ See if you qualify for Home Caregiving Grant (HCG), ElderFund, or CareShield Life payouts.

✔ Compare employer-provided benefits—some workplaces offer childcare support or caregiver leave policies.

- The Evolving Role of the Sandwich Generation

With fewer children supporting elderly parents, ensuring financial independence is more important than ever. Singapore’s fertility rate hit 0.97 in 2024—an all-time low—which means fewer people to share caregiving responsibilities in the future.

📌 What You Can Do: Make Family Finance a Team Effort

✔ Hold regular family financial check-ins to align caregiving responsibilities and expectations.

✔ Use a shared expense tracker (Google Sheets) for better transparency.

✔ Teach financial literacy early—involve children in small budgeting and saving decisions.

✔ Give kids hands-on experience—let them manage small budgets for outings or purchases.

When we normalize financial conversations, we reduce stress, set clear expectations, and empower future generations to manage money wisely.

- Outliving our retirement savings is becoming a real concern.

Many of us will live well beyond retirement age and rising healthcare costs, are we financially prepared for 20-30 years of retirement income? CPF Life alone may not be enough to maintain our lifestyle in retirement.

📌 What You Can Do: Take a Guided Approach to Long-Term Wealth Building

✔ Instead of relying on CPF Life alone, explore financial strategies that diversify income streams while ensuring stability.

✔ Work with a financial advisor to ensure your financial plan aligns with your future goals and lifestyle needs.

💡The earlier we start, the more flexibility and control we have over our financial future.

- Recent CPF changes mean it’s time to rethink financial planning.

From January 1, 2025, the CPF Special Account (SA) closes at age 55. Many are now wondering: Where can I find stable, low-risk returns beyond CPF?

📌 What You Can Do: Ensure Your Plan Extends Beyond CPF

✔ Don’t wait until 55—planning early ensures a smooth transition from CPF to alternative retirement income sources.

✔ Consider financial instruments beyond CPF, such as personal retirement plans, diversified investments, and structured income streams.

✔ Seek expert guidance to ensure a solid, long-term financial strategy.

💡 The difference between financial stress and financial confidence is in how well you plan ahead.

- Traditional Savings Instruments: Fixed Deposits, Singapore Savings Bonds (SSBs), and T-bills may no longer be enough.

With Fed rate cuts expected, these instruments could become less attractive. So, what’s next?

📌 What You Can Do: Diversify Your Income Streams

✔ Having multiple income sources provides financial stability and shields against economic fluctuations. Consider freelancing, tutoring, reselling, or monetizing a hobby.

✔ Explore financial tools that offer both protection and long-term wealth accumulation beyond CPF and savings accounts.

💡 Making your money work for you is more important than ever. A structured plan helps you navigate rising costs, changing policies, and evolving market conditions.

Why Playing to Win Matters

I’ve seen firsthand how small, intentional steps lead to long-term financial security. Many individuals have already taken proactive steps to grow their wealth, ensuring they’re not just keeping up with rising costs, but navigating them with clarity and confidence, and staying ahead.

💡Think about it: Are you managing your finances just to “get by,” or are you positioning yourself to win from the start?

When you play to win, you’re not just staying afloat—you’re setting yourself up for stability and freedom.

Small Steps Today, Big Impact Tomorrow

If you’re ready to start making empowered financial decisions, I invite you to take that first step—whether it’s gaining clarity on your current situation, exploring new opportunities, or figuring out your next best move.

💡 Here’s something you can do today: Review your cash flow, reassess your financial goals, or explore ways to make your money work harder for you. Small, intentional actions add up.

If you’re looking for clarity on your options, let’s have a real conversation.

Financial confidence isn’t built overnight—but it starts with one decision, one action at a time.

Your future self will thank you for it.