Does Maid Money Matters?

When it comes to our helper’s financial literacy, it was easy to assume that she knew what to do with her loans, cash, savings and more.

We recently hired a Migrant Domestic Worker (MDW) and a few months into her contract, I’ve learned that she needs to be guided on managing her hard-earned money.

As a financial planner myself, I always believe in self-improvement and helping my close ones be better financially educated before assisting others. As my MDW’s loan with her agency was ending, I sat down with her to work on her finance management.

Maid Money Matters

This was how I helped my helper have better clarity on her money matters:

Stuck with a loan to work in Singapore

This is the most common situation for domestic helpers who come here through a maid agency. They usually do not have enough money to pay the agents involved for taking care of their training, interviews, lodging and medical checks etc, before meeting their new employers. The usual practice would be for helpers to receive a portion of their salary for the first few months, to pay off that loan from you, the employer. Yes, this is one of the things employers pay when hiring a helper – maid placement fee/loan.

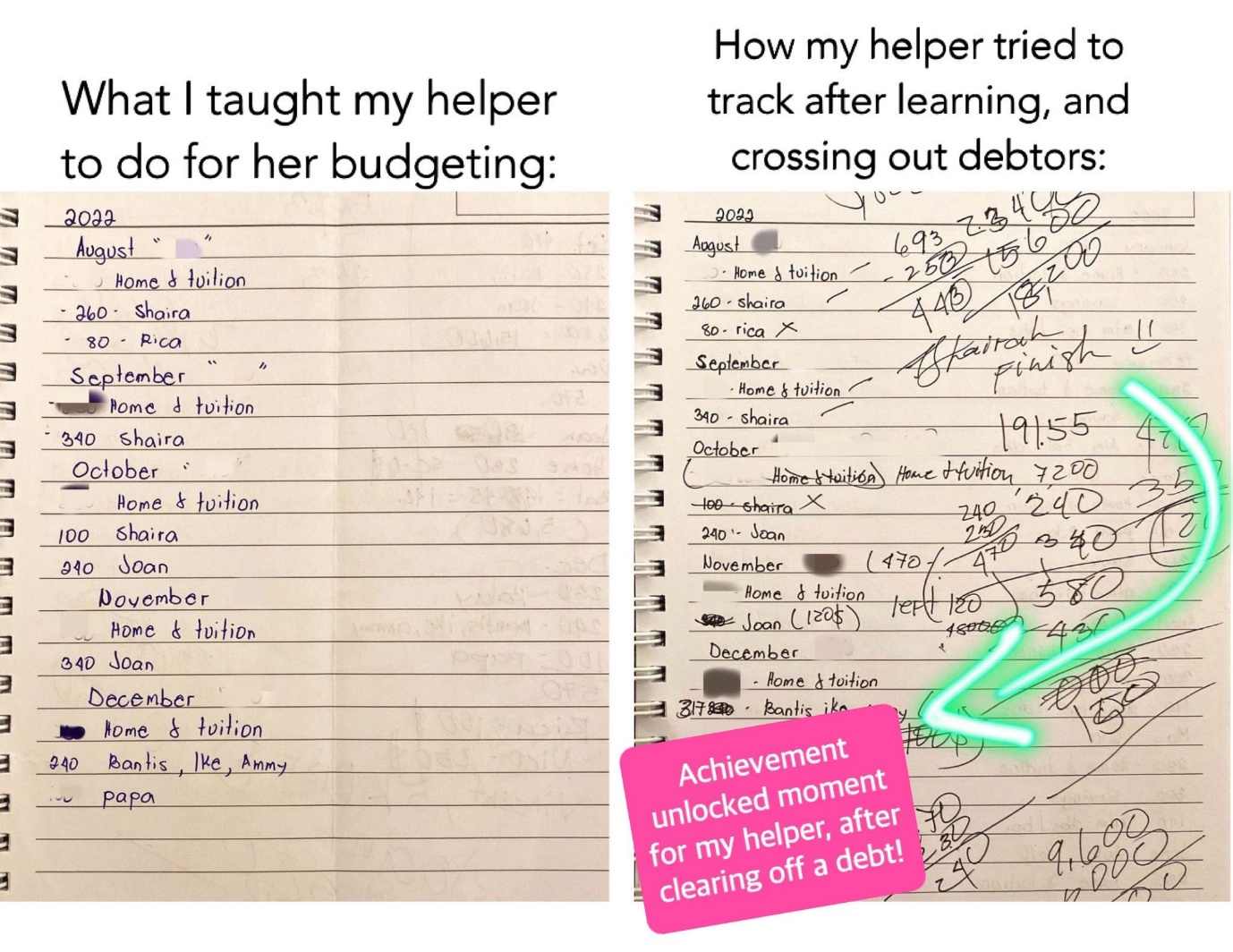

You would be surprised that they may have other loans besides the agency loan, such as, borrowing from friends and relatives. So, the first rule to financial planning is cash planning. I empowered her to write down how she would pay off her debts with her monthly salary. When we had a session to review her planning, her initial numbers were messy and inconsistent – she couldn’t quite explain what she wrote too.

Write it out – budgeting planning, salary and debt repayments/loans

First, there is no need to save for the time being, as her daily living expenses (necessities) are being paid for by us (employers). Her salary can be split between fixed amount (fixed expenses to send home/parents and children’s education needs) and debt repayments.

For debt repayments, start with the one that charges the highest interest – which was a loan from her dear friend. Yes, her friend charges her interest and there was a written IOU! After writing that down, she could see that by end of this year, she would be able to pay off all her debts and start afresh in 2023!

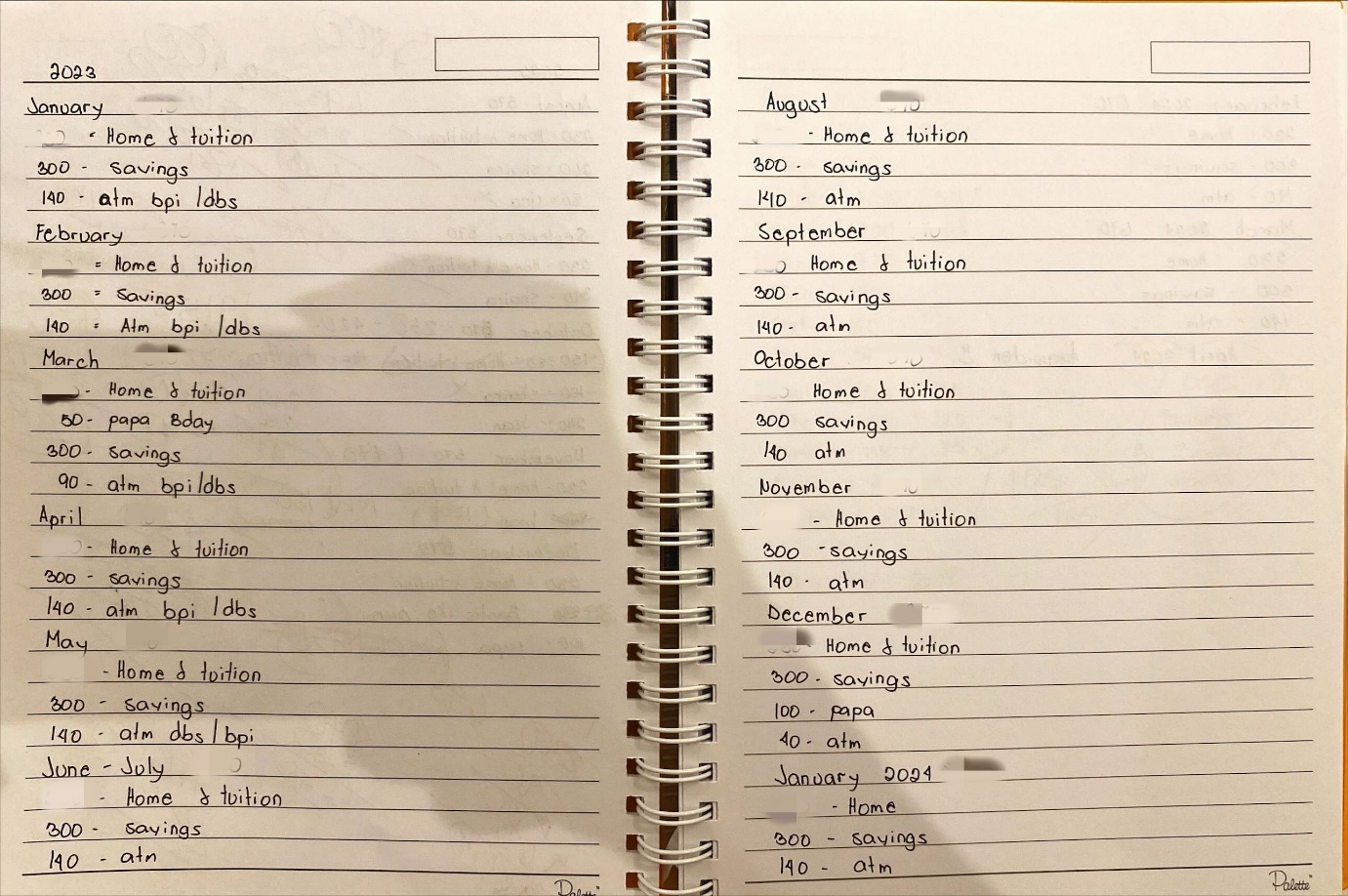

Saving up for her wish list

Knowing “why” she’s working in Singapore will help her identify some personal goals that would also remind her why she’s working here. For e.g., she can save her hard-earned money for an asset that would benefit her and her future needs. Saving up to buy a property or to build a house on a plot of land works like a “forced saving” which is positive financial management.

List out her needs and wants

Next, after listing down her savings (financial goals, lifestyle for herself and children), she wrote down her needs and wants. It’s normal to have temptations like yearning for the latest smartphone. She pasted the schedule on the wall in her bedroom and is looking forward to realising her plans. That’s instant motivation with clarity!

Be prepared for unexpected borrowing

It’s common for family and friends back home to envy her high income as an overseas worker. There are many reasons for borrowing money: a family member is sick, a typhoon washed out a relative’s home, a sibling lost his job and has young kids to raise etc. The situation back home adds stress to the helper, and if she can help by sending money home, she would. If she doesn’t have enough money, she may also turn to borrow from employers. But how much is too much for both of you?

When she feels in control of her finances and of the financial goals she wants to achieve, she will feel the pinch when spending without thinking. Thus, being equipped with financial literally guides her to think more logically and learn how to manage sticky situations. What’s heart-warming was that she even shared these financial planning tips with her helper friends!

Like other employees, a happy domestic helper is more likely to be loyal to your family. You may consider sending your domestic workers to cooking classes or learn First Aid, particularly if you have young children. Maids who are more skilled will likely command a higher pay, but they bring additional benefits to families too.

Did you know that working mothers in Singapore may claim the Foreign Domestic Worker Levy Relief (FDWL) by offsetting your earned income? As employers, guiding our helpers with financial knowledge helps them manage their money better. Hopefully, there will be lesser money issues for us, like asking for advance salary or even borrowing from credit loan companies. Feel free to reach out to me should you need clarifications.