Our children’s education fees can be pretty substantial, yet it is an essential investment for them. Thankfully, childcare subsidies in Singapore help families save on education expenses.

Experts note that a child’s first 1,000 days (or their first 3 years of life) marks exponential growth in their brains. Thus, it is dubbed as the best time for learning and exposure, and that can include academic knowledge too. Besides choosing the “right” preschool for our kids, we often wonder how to prepare them for their first day at school. We’ve got them covered – so feel free to read those articles.

Besides baby necessities such as diapers and formula milk, the next big-ticket for families would be child care and infant care costs. Fees can range be $500 per month or $2,500 per month.

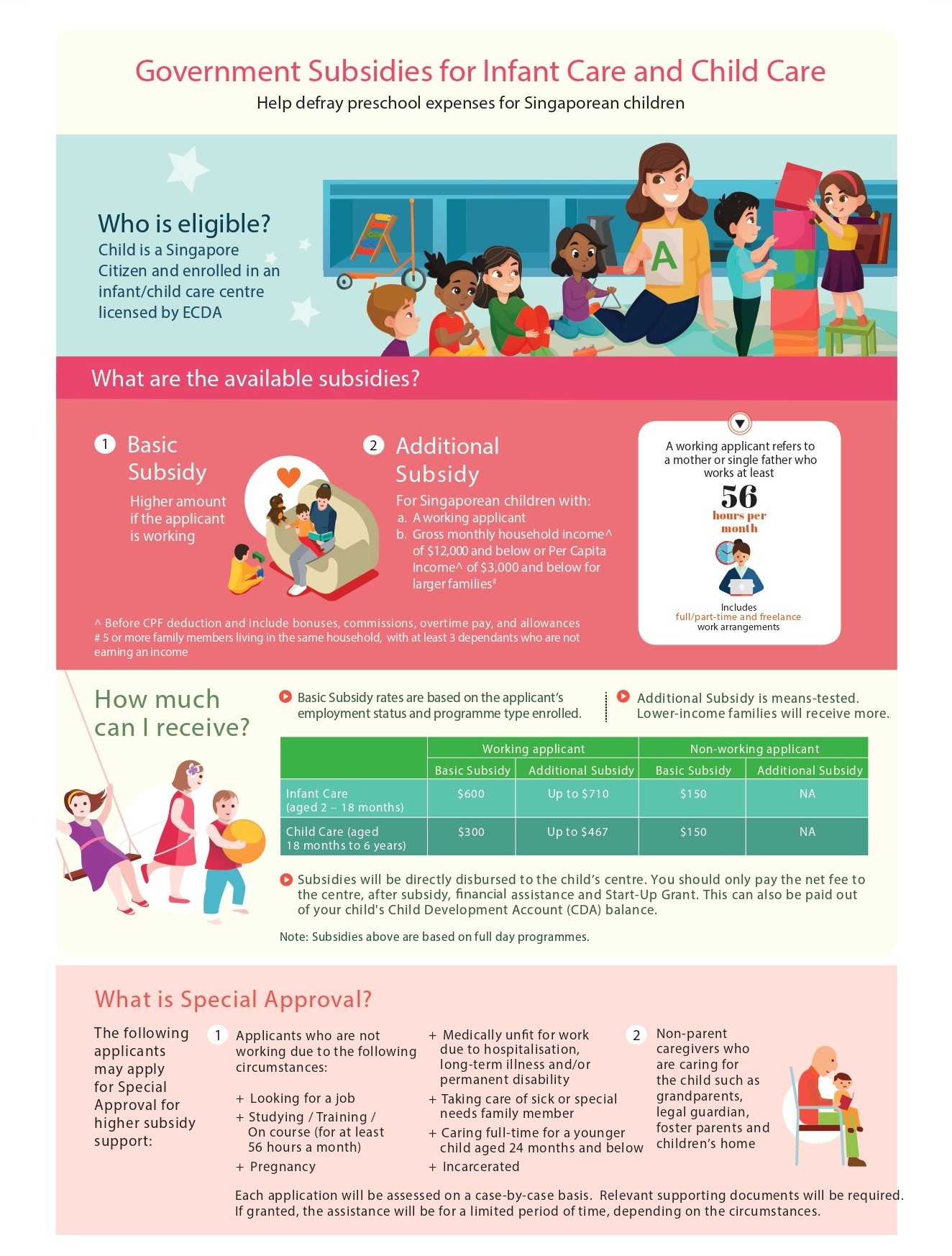

Childcare subsidies in Singapore: What’s available?

Basic subsidy for childcare in Singapore

Working parents of children who are Singapore Citizens get to enjoy the Basic Subsidy of up to $600 per month of full-day infant care service and up to $300 per month for full-day childcare arrangements. The Early Childhood Development Agency (ECDA) must license the preschool institution.

Additional subsidy for childcare costs – from 1 January 2020

Additionally, families with working mothers that meet the gross monthly household income of $12,000 and below are eligible for the Additional Subsidy. Under this scheme, lower-income families will receive more savings on their child’s infant care or childcare fees.

Besides the income eligibility, the family must have a gross monthly per capita income of $3000 and below for larger families with at least 3 dependents who are not earning an income.

At the same time, working mums or single fathers should work a minimum of 56 hours a month and that can include part-time and freelance work.

Enhanced Kindergarten Fee Assistance Scheme (KiFAS)

If you are considering sending your child to a local kindergarten under the AOP scheme or MOE Kindergarten, there is also the Kindergarten Fee Assistance Scheme (KiFAS) for families with a gross monthly household income of $12,000 and below.

Larger families with 3 or more dependants can also choose to have their Additional Subsidy or KiFAS computed on a Per Capita Income (PCI) basis.

With a large option of private and government-supported preschools in Singapore, families can choose one that meets their needs, along with fees that they are comfortable with.

Full-day child care subsidy for Singaporean children by Anchor Operator (AOP)

According to ECDA: “The Anchor Operator (AOP) scheme provides funding support to selected preschool operators to increase access to good quality and affordable early childhood care and education, especially for children from lower-income or disadvantaged backgrounds.”

Under the AOP, parents can expect a monthly fee cap of $720, $1,275, and $160 (excluding GST) for full-day child care, full-day infant care, and kindergarten respectively. Preschools keep any fee increases affordable for parents.

Affordable childcare fee caps under Partner Operator (POP) scheme

Besides the AOP scheme, some childcare are under the POP scheme where school fees are kept within a certain cap too. In fact, some of these preschools are SPARK-certified too, which means they have met the stringent criteria to attain be SPARK certification.

According to ECDA: “The Partner Operator (POP) scheme supports appointed centers to improve the accessibility, affordability, and quality of childcare and infant care services.”

Partner Operator (POP) scheme monthly fee cap of $760 and $1,330 (excluding GST) for full-day child care and infant care program respectively.

Find out if your preferred infant care and child care centers are within your budget with this subsidy calculator

Here is an easy way for you to find out how much fees you will pay after deducting the subsidies that your family is eligible for – click here.

Hope the information about childcare subsidy can help you and your family make an informed and practical decision on projected children’s expenses. After all, this is just the beginning of our kids’ education journey. Do you have an education fund mapped out for your children? If not, perhaps it’s time to start planning for their university fees and insurance planning too. Feel free to reach out to me for any financial planning matters for you and your family.