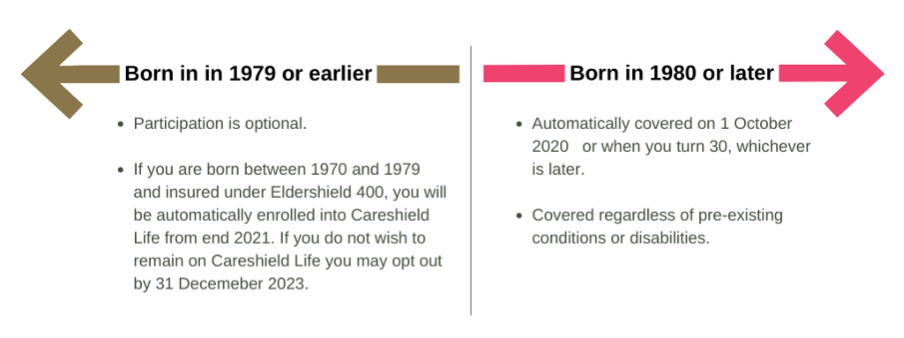

From 1 December 2021, Singapore Citizens or Permanent Residents (PR) born between 1970 to 1979 who are covered under the ElderShield scheme and without severe disability, were automatically enrolled into the Careshield Life scheme.

However, if the auto-enrolment didn’t happen and you do not have severe disability now, you can choose to join CareShield Life for higher and lifetime monthly disability benefit. Should you join CareShield Life by 31 December 2023, you will enjoy Participation Incentives of up to $4,000.

What is CareShield Life and Why is it Compulsory?

CareShield Life is a mandatory long-term disability benefit and care insurance scheme which extends basic financial support to Singaporeans who become severely disabled (especially during old age) and require personal and medical care over a prolonged period.

With this, the Singapore Government aims to address the ageing population, reduced family sizes, financial support for family members and future long term medical costs.

For those who turn 30 from 1 October 2020, they are automatically included into CareShield Life. It is optional for those born in 1979 or earlier; auto-enrolment happens from 1 December 2021 for those born between 1970 and 1979, insured under ElderShield 400, and not severely disabled.

CareShield versus ElderShield Plans

Think of CareShield Life as an improved version of the ElderShield. The former was structured to provide us with better protection and assurance for our long-term care needs. If you wish to understand more about your existing ElderShield coverage or your ElderShield supplement plans like Singlife Aviva MyCare or MyCare Plus, get in touch with me and I’ll take you through it.

CareShield Life Benefits to Cushion During Severe Disability

With CareShield Life, “severe disability” means unable to perform at least 3 out of 6 Activities of Daily Living (ADLs).

As such, the individual will need a caregiver in his daily life, or even require physiotherapy sessions. Long-term care costs can vary depending on an individual’s needs, desired care arrangements and financing means.

Benefits of the basic CareShield Life:

- Lifetime monthly cash payouts, for as long as the insured remains severely disabled

- Increasing monthly benefits. Starts at $600/month in 2020 and increases yearly until age 67 or when a successful claim is made, whichever is earlier. The possible payout increases yearly, going up by 2% annually for the first 5 years.

- For those born in 1980 and later, pre-existing conditions and severe disabilities are covered, entitling the insured to the disability payouts

- Careshield life premiums are fully payable by MediSave

What to note about CareShield Life and its monthly benefit payouts

When an insured person starts receiving monthly benefit payout, the yearly amount received will be based on amount of the first monthly payout. This amount will not change even if the scheme raises monthly payouts over the years.

Jenelle’s financial tips: To find out how much the CareShield Life premium will cost you at your current age, use the premium calculator (log in with Singpass) to check.

Since the CareShield scheme works like a basic health insurance coverage, the monthly disability payouts may not be sufficient for you when severe disability hits. Hence, there is the option to upgrade your CareShield Life for higher coverage, disability monthly payouts and with additional benefits.

Benefits of Upgrading Your CareShield Life

For someone with a severe disability with just $600 a month, it doesn’t seem sufficient at all.

To upgrade your CareShield Life, first, you need to have an existing in-force basic plan (either ElderShield or CareShield) to apply for the supplement plan.

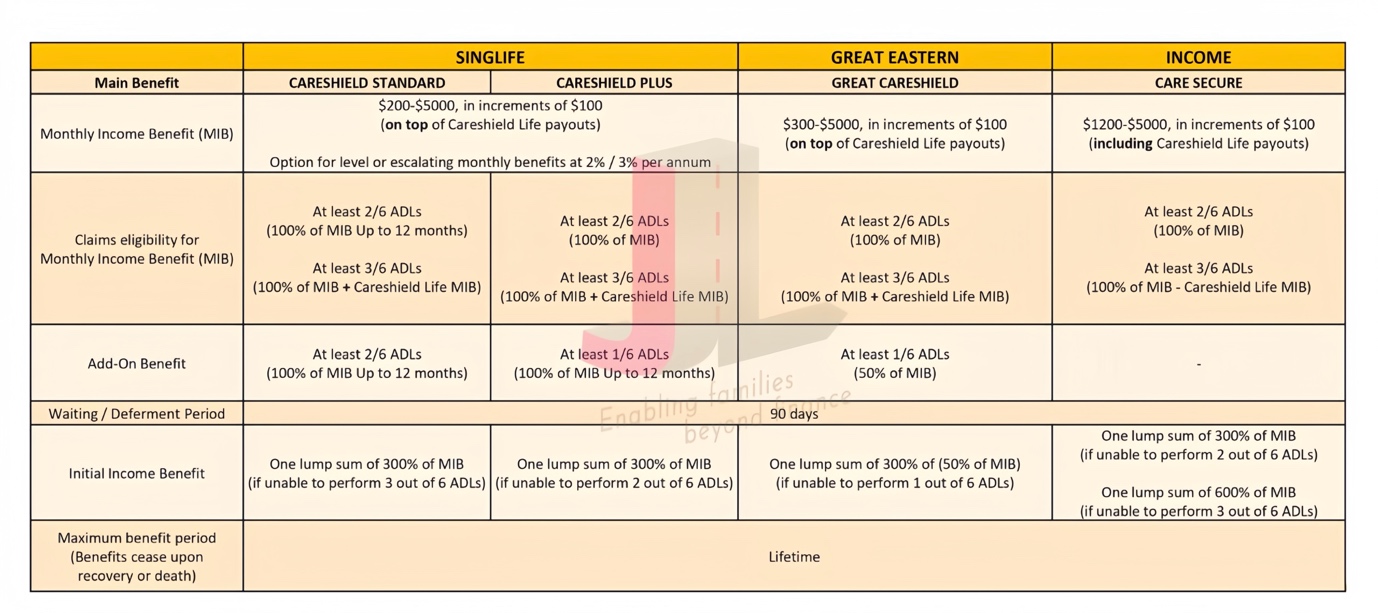

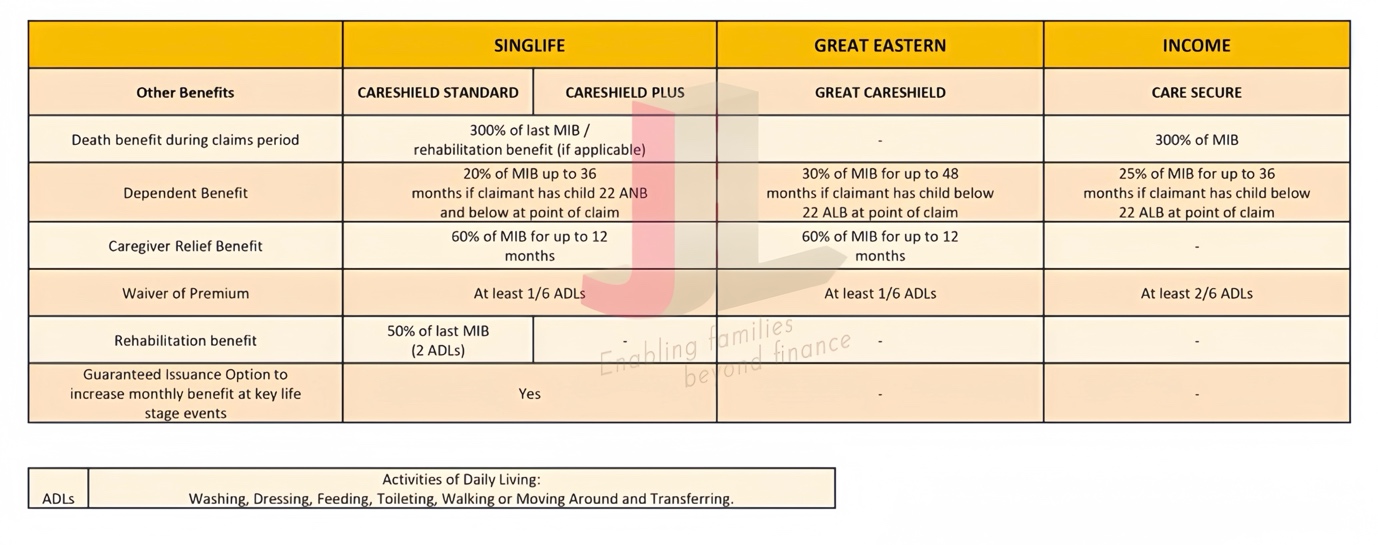

There are only 3 insurance companies that offer upgrading with CareShield Life supplements:

Here is an overview of the CareShield supplements:

Key reasons why clients top-up their CareShield Life with supplement:

- To upsize the monthly benefit payout up to $5,000 (this would entail using cash for the premiums)

- Meet an easier claim eligibility based on fewer ADLs (e.g. pay-outs are possible with 1 or 2 ADLs met, instead of 3 out of 6 with the original CareShield Life plan.)

- Prefer a different premium payment term e.g. pay till 99 years old instead of the original 67 years old.

- Utilise CPF MediSave to pay for your premiums (up to $600 annually) without using cash

Is it worth to upgrade CareShield Life?

Reports have shown that Singapore seniors need at least $1,379 monthly for basic needs in 2019 – and that has yet to include hefty long term medical care should disability conditions kick in from entry age of 30 to old age.

Looking at the increasing costs thanks to inflation, and the projected future healthcare needs and medical bills, it would be wise to ensure that we have sufficient coverage to tackle future medical needs.

With a comprehensive analysis of your needs and budget done by a trusted financial advisor, you will enjoy better peace of mind without more financial stress or having to top-up cash, if preferred. Feel free to contact me for a complimentary consultation.