With the rising cost of education and living expenses, it’s imperative to start thinking about your children’s future education plans. Studying abroad might be one that your children may wish to embark on. Several benefits include gaining global experience, learning to be independent and resourceful, and future work opportunities.

However, the cost for enrolling into a university in Singapore versus an overseas university can be significantly different. How much savings will be needed to afford the university fees and other expenses?

Universities in Australia, Britain, Canada and the United States have always been a popular choice among Singaporeans. In a recent trend observed, top destinations for Singaporeans students considering overseas education are seeing a shift to universities in Japan, Germany, France and The Netherlands instead.

Let’s take a look at the costs involved to enroll a Singaporean student and how to save up for the preferred education journey.

NUS and NTU are ranked as top universities, attracting students from other countries to aim for them too. For Singaporeans to enroll in local universities, costs will include annual tuition fees for the undergraduate programme and living expenses like hostel rental if your child decides to stay there.

Unlike spending on his/her education in a university in Singapore, there are additional expenses when living and studying overseas. When budgeting, remember that it’s not only these education-related costs to consider; other aspects of a parent’s life e.g. retirement planning would require a portion of available finances too. Are there “sacrifices” you will need to make to adjust and send him/her to study abroad?

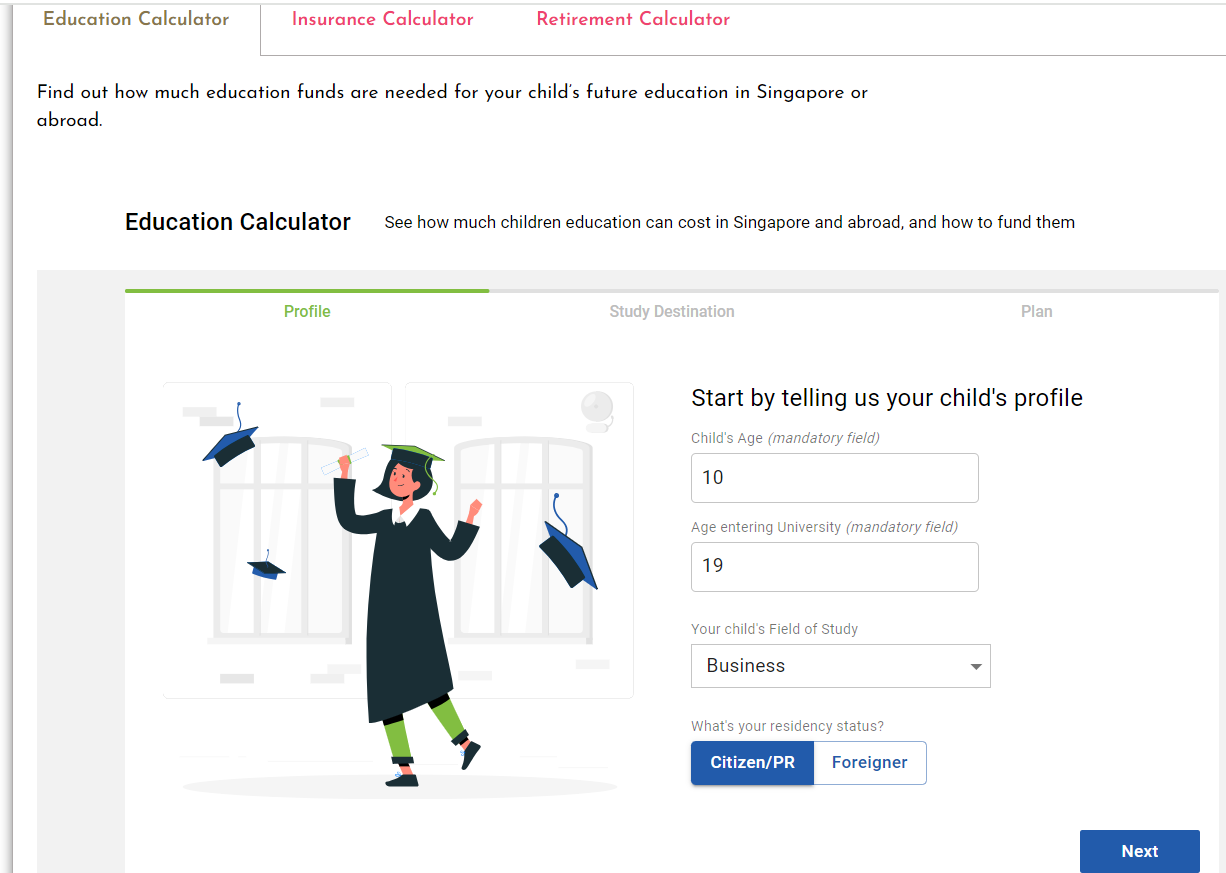

Step 1: Work out the number of years before your child starts university

How old is your child now? Next, consider how old your child will be by then – most likely after ‘A’ levels, which is around 18 or 19 years old. This will help you estimate the number of years for which you need to save.

Step 2: Determine the years of education abroad

Find out the duration of the undergraduate programme your child is interested in. Doing so helps you determine how long your education savings need to last over a specific period.

Step 3: Calculate the estimated costs of studying in a Singapore university versus studying abroad

To alleviate families of the education costs, Singapore Citizens are eligible for a bond-free MOE Tuition Grant for selected diploma and undergraduate courses in Singapore.

Undergraduate tuition fees at local universities indicated in the below table reflect the subsidised fees. For comparison on education abroad, some of the popular overseas universities amongst Singaporeans are listed below.

Tuition fees depend on the field of study your child is applying for, and may also incur other related expenses. Also, most courses are typically a 3-year duration; dentistry and medicine degrees take 5 years or more. As international students enroll abroad, school fees will be higher compared to their local students. Do note that fees differ from students studying medicine and nursing. Enrolment and application fees vary across schools too.

At the same time, living costs need to be factored in. This includes accommodation e.g. rental costs and utilities like heating, electricity and Wi-Fi. There are also food expenses, personal items (e.g. toiletries), transport costs, social activities, study costs (e.g. stationery, textbooks) and other miscellaneous expenses such as mobile bills and insurance. Remember to factor in the exchange rate when calculating the overseas education cost.

Jenelle’s financial tips: Students can also consider the interest-free MOE Tuition Fee Loan when applying for local tertiary courses.

Step 4: Assess current savings and investments

This gives you better clarity on your current financial status and akin to doing a stocktake of your finances, and the projected cash-on-hand to start saving for your child’s university education funds. For financial instruments that garner a rate of return by a certain period, it is important to review the timeline and how this would affect saving up to send them abroad too.

Step 5: Calculate the shortfall and account for Inflation

At this step, subtract your current savings from the amount (step 4) required to meet your projected costs after admission into a local or overseas university and other expenses (step 3). This figure shows how much additional savings you need to accumulate for his/her undergraduate plans.

Next, consider inflation on your child’s education savings, in order to set these financial figures against reality. Purchasing power is eroded by inflation over time, hence accounting for it is necessary when calculating the amount required to save.

Step 6: Calculate the required savings amount

With the information obtained from steps 1 to 5, calculate the amount required to save today and identify the gaps.

Use an education planning calculator to get an estimate of your child’s future education expenses.

How to evaluate your saving options to achieve your savings goal

Work out an investment strategy that aligns with your risk tolerance and time horizon to achieve that educational financial goal. This may involve a mix of methods such as stocks, bonds, mutual funds, or other investment vehicles. To obtain a more accurate estimate based on your circumstances, reach out to an experienced financial advisor in Singapore.

If the calculated savings required seems unattainable, it is a sign to reassess your savings plan. This could mean increasing your savings rate, reducing expenses from now and over the savings period, or exploring additional investment opportunities to boost this education fund.

Saving up for university education can be achievable for Singaporean families

Whether you are saving up for local university enrollment or planning to send your children to pursue his/her studies abroad, start saving up earlier than later. Working out the education budget and how much money to set aside feels stressful? I’d be happy to help simplify matters and turn that confusion into a clearer perspective for you – get in touch!