Mums and dads, have you started making plans for retirement? If not, has the COVID-19 pandemic spurred you to save up more, or has this stopped you in your tracks?

We checked in with some parents in Singapore to understand about their sentiments towards retirement planning and whether this downturn has influenced their financial goals. Let’s find out!

Are retirement plans in place for mums and dads?

This period has been challenging for many parents. The new norm now includes a mix of work-from-home, homebased learning (HBL) for kids and extended school holidays.

Working mum of 2, Madam Lai, says that she somewhat has some plans in place for retirement. Her husband, however, feels that the retirement idea is too far away for him, and he prefers to think about the present day-to-day instead of the near future. Some of us are swarmed with the daily grind and prefer to focus on making sure earning an income is critical for the growing expenses of their family.

This echoes what Mrs. Ang has at the back of her mind, but she knows that some planning needs to be done soon. However, she hasn’t proactively made concrete plans.

In some sense, it does help if your spouse is a “numbers person” and decide to start planning before COVID-19 hit. Jessica and her husband started their discussion and retirement planning after having their 2nd child who turns 8 this year.

What are some steps parents are taking towards achieving their retirement goals?

There’s a saying: Do you spend more on a weekday or a weekend? Every day is a weekend when we retire. Folks want to grow their wealth and make our hard-earned salaries work harder for us so we can have a comfortable “allowance” after we stop working.

Some call this the “financial freedom” status, where one can live freely without any financial stress.

Amongst these parents, investment and financial planning are common options. From these, a mum explained that she decided to diversify her portfolio. This means setting aside funds in different places including bank saving accounts, insurance plans, a little on shares investment and also trying to build up her CPF Saving Account (SA).

Ultimately, it is about working with a sum that one is comfortable with. Having an end goal in mind, paired with consistency and discipline are instrumental for building one’s retirement pot.

Has COVID-19 affected your retirement plans?

For Madam Lai and Jessica who already have their plans somewhat mapped out, this pandemic has no impact on their retirement planning and financial roadmap for themselves.

“With a 3rd kid, we rechecked our finances, replan abit then continued with our plans, but COVID doesn’t impact any plans so far,” explains Jessica.

But for Mrs. Ang, it was her husband who reminded her that they were approaching 40. Additionally, it’s time to lock in some plans because both pairs of aged parents may also need some funds for medical needs in time to come. She does recognise that it is a good time to start during this COVID-19 period, especially when it comes to varying risk products like investment-related plans. But the lack of knowledge and the seeming need to have a big sum of money are just some of the roadblocks to get started.

Can you achieve your retirement goals with the existing plans mapped out?

For Jessica and her husband, they feel that everything is on target so far. Their confidence is in place, and it helps that planning started pre-COVID and before their 3rd child was birthed when the outbreak started.

“I haven’t really set a specific amount of how much I need for my retirement (probably I should do that). Meanwhile for me, I’m trying to build up my assets in a steadily manner and within my means.” shares Madam Lai.

Jenelle’s financial advice on retirement planning in Singapore

Like most families, I’m a mother with young kids with aging parents to care for. Retirement may seem possible only 20 to 30 years later, but the key idea is to start early as a little goes a long way.

I’ve met prospects who experienced pay cuts or retrenchment. This greatly affected their ability to service their monthly expenses, including retirement plans.

Hence, it is important to speak to your trusted financial advisor and be opened about any change in financial status. The idea is to review and work together to ease liquidity. Don’t be surprised that the cash/investment value plans that you have been committing to for several years, can come in handy during this pandemic. You can either do partial withdrawal, policy loan or even take premium holiday (not having to pay premium temporary while staying covered).

Does this sound like your current situation? Take a moment to ponder over my Financial Roadmap, which has been guiding me throughout the years.

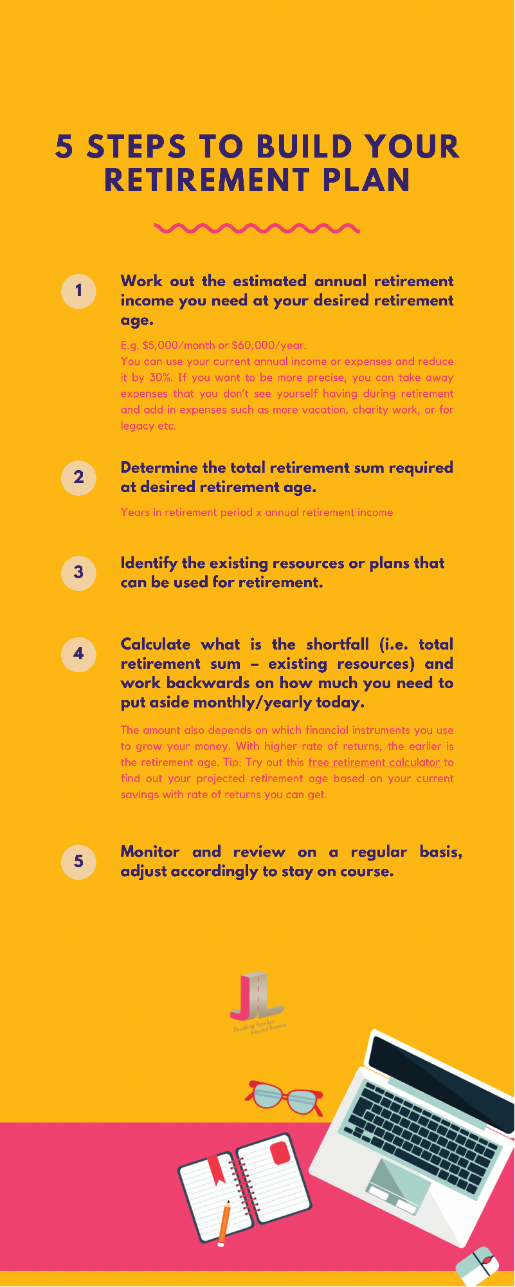

This is how I have been planning for my future retirement using Jenelle’s 5-step system

Everyone knows retirement planning is important, but many do not have an end in mind. It is not just about saving and investing what you can or being frugal with your current lifestyle so you can have a better retirement.

When you have an end in mind, then you will stay committed and action with consistency. You will always know you are in the right direction when life throws challenges at you, such as the current pandemic. No plans are perfect, but at least you know your direction is right.

Personally, I use these 5 steps for myself and clients to calculate how much will be needed to save/invest today to achieve the desired retirement income when I stop working. This has provided clarity to my clients allowing them to understand the big picture broken down into smaller parts. The bottom line is – it is okay to start small. With an end in mind, slowly and surely, one will be able to catch up with the shortfall whenever financial status improves.

Here’s how you can try calculating your retirement income in 5 steps:

The amount also depends on which financial instruments you use to grow your money. With higher returns, the earlier is the retirement age. Tip: Try out this free retirement calculator to find out your projected retirement age based on your current savings and spending today.

Planning requires computation for accuracy, so we need to factor in inflation, investment and consumption rates. We need our projected retirement numbers to be as close to we really need for retiring. However, there may also be other parameters that may influence this such as disability/critical illness/accident, or retrenchment, change of job etc.

For a more accurate grasp of your retirement needs, feel free to reach out to me or talk to your own financial advisor. This way, I can show you how you can achieve what you want realistically through a system without compromising your current lifestyle while overcoming the qualitative factors. I am here to provide clarity, propelled with consistency in action to help you achieve the financial confidence that you deserve.

“To begin with the end in mind means to start with a clear understanding of your destination. It means to know where you’re going so that you better understand where you are now and so that the steps you take are always in the right direction.”

— Stephen R. Covey

4 Responses