Having a baby introduces a new chapter for the family. Raising children also brings more expenses, and the Singapore Government provides the Baby Bonus Scheme to help parents manage financial concerns. The Baby Bonus Scheme offers cash gifts and contributes to the Child Development Account (CDA) to help mums and dads meet their growing family’s needs.

Did you know that the CDA and the Baby Bonus Cash Gifts are different?

The government gives the Baby Bonus cash gift to babies who are Singapore Citizens to help defray the costs of having children.

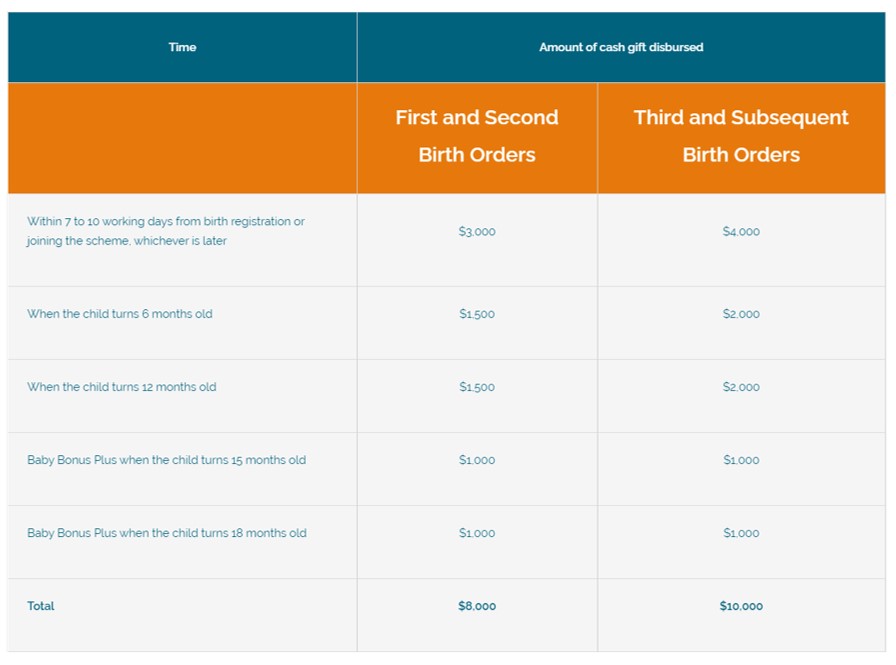

The Ministry of Social and Family Development shows a table listing the cash gift each child in the family will receive. These rates are applicable for babies born from Jan 2015 onwards.

The government credits the amount directly to parents’ bank accounts and deposits it over an 18-month period in five instalments. The table below shows the pay-out breakdown:

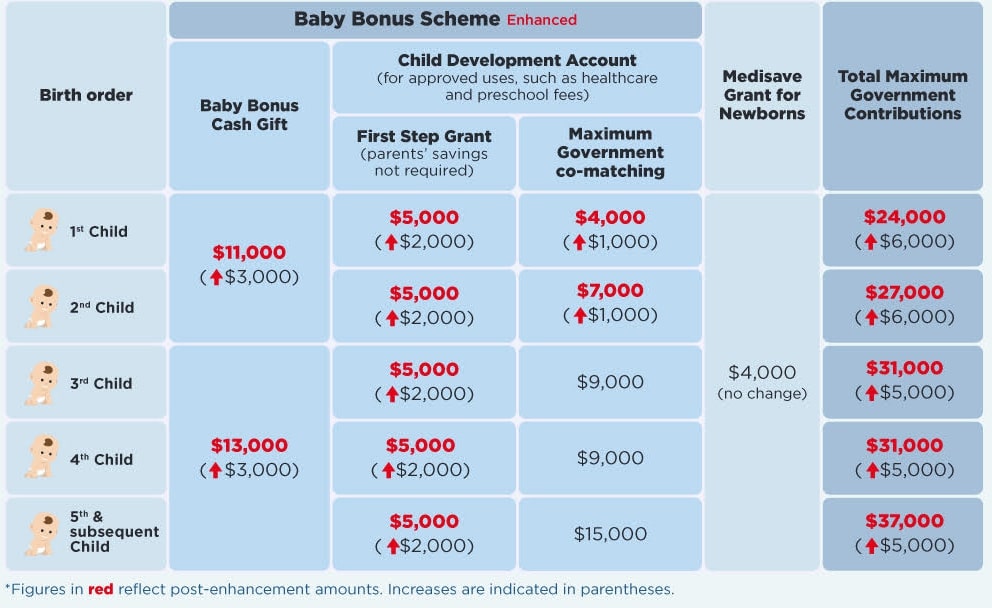

Enhanced Baby Bonus Benefits from 14 February 2023

- Additional $3,000 Baby Bonus cash gift for married couples with Singapore children born on 14 February 2023 onwards. Note that they will disburse the funds until your child turns 6.5 years old, unlike before where the period was your child turns 18 months old.

Extra Baby Bonus Grant for babies born during the Covid-19 period

Planning for children? The Singapore Government has implemented extra financial support for new parents this season. During such unprecedented times, some families may face pay cuts or a loss of income, and they may also shelve thoughts of marriage and family planning.

During pregnancy, some of us may also think about getting a maternity insurance as a financial protection against pregnancy complications and congenital illness for baby. Before the baby is born, families usually discuss postpartum support options, such as whether to hire a confinement nanny. That’s where extra money can be pretty handy.

From 1 October 2020 to 30 September 2022, mums and dads of children born during this period will be eligible for the one-off Baby Support Grant (BSG) of $3,000 for each child. The government provides an extra Baby Bonus Grant for babies born during the Covid-19 period.

This $3,000 Baby Support Grant is offers in addition to other family grants and parenthood subsidies like childcare and infant care assistance.

Extension of Baby Support Grant (updated 14 February 2023): Good news for parents with kids

born 1 October to 13 February 2023! The government extends the financial support period for births, and you will receive this extra cash support too!

Parents can use the Baby Bonus Cash Gift without restrictions, while the CDA funds follow a dollar-for-dollar matching system. You can use them for baby’s necessities, such as diapers and formula milk powder, or invest them in plans to grow your wealth and savings further.

Wish to find out if your newborn is eligible for these gifts from the Government? Check out the Baby Bonus eligibility tool.

Jenelle’s family financial planning tips: Parents should apply for the Baby Bonus Scheme at least two months before their baby’s Estimated Delivery Date (EDD) or before birth. Sign up here to apply.

Planning ahead for your family’s health, wealth and education expenses

Are you worried about insufficient health insurance coverage? Are your savings optimised to meet your retirement plans? Do you have enough funds set aside for your children’s future education expenses?

As the sandwich generation where we have little ones to nurture and our aged parents to care for, it is easy to forget the present where we simply focus on earning an income but neglect savings or making our money grow further.

With some budgeting in place and a clear financial roadmap drawn up, turning financial concerns into financial confidence is possible. Take charge of your family’s future today. Feel free to get in touch for a complimentary consultation to find out how.

Note: This article was updated in February 2023.