Welcoming a new baby marks exciting times ahead! To celebrate, the Singapore government has plans and cash gifts to help families ease their financial costs. So, what is the difference between the Child Development Account (CDA) and the Baby Bonus cash gift for babies in Singapore?

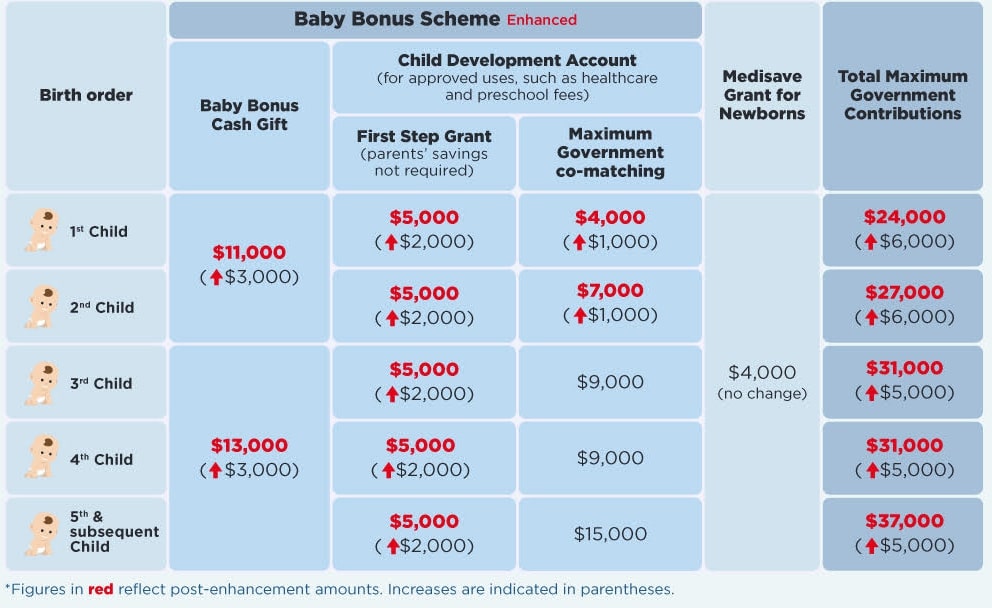

Both are initiatives under the Baby Bonus Scheme. In short, the CDA is a separate account from the Baby Bonus cash gift that children receive. The CDA comes with a dollar-to-dollar matching from our government, helping parents to save and double up the funds. The latter are sums paid out periodically until the child is 18 months old.

With each registered baby, parents can apply for their child’s CDA online with any of the local banks, DBS/POSB, OCBC or UOB. This CDA helps parents to save up for their children’s expenses and the saving funds remain in this account until the child turns 12.

How to maximise savings with the CDA?

- Every Singaporean child will receive $3,000 automatically credited to their CDA and this is known as CDA First Step.

- Government extends a dollar-to-dollar matching of the savings for the child, according to the birth order and maximum government co-matching cap. Do note that in Feb 2023, the co-matching amount increased by $1,000 for the first 2 births.

- For parents who are looking to maximise savings and contributions in the CDA, the best way would be to contribute the maximum amount that the Government is extending.

- Since the CDA funds are in a bank account in Singapore, that means you can earn interest too. Additionally, banks are offering various benefits such as merchant discounts when you open a CDA. Parents, you can do your research and choose the best bank with the benefits that you want.

Additional CDA benefits rolled out on 14 February 2023:

- Applicable for eligible Singaporean children born on or after 14 February 2023.

- The additional $2,000 will be deposited into the CDA account for all children, regardless of birth order.

- Enhanced amounts will be paid out from 2024 – with the additional cash from the

Government, parents will receive up to $24,000 for the first child and up to $37,000 for subsequent kids.

How do I use my CDA money?

With the CDA ATM card issued by the bank where your child’s savings are deposited, you can use the money at Approved Institutions (AI) registered with MSF under the Baby Bonus Scheme. Siblings can use the funds in a CDA, even if one of your children does not have an account.

Jenelle’s Tips: To be honest, the funds deplete quite quickly if kids attend childcare and kindergartens, or visit the paediatrician often. Find out about infant care and child care subsidies to help manage your family’s finances.

What else can CDA be used for? If you are wondering where else to use your kid’s CDA ATM card, refer to this list:

- Childcare centres licensed by Early Childhood Development Agency (ECDA)

- Kindergartens registered with ECDA or Council for Private Education (CPE) and special education schools registered with the Ministry of Education (MOE) respectively

- Early intervention programmes registered with the Ministry of Social and Family Development (MSF)

- Hospitals, clinics and other healthcare institutions licensed by the Ministry of Health (MOH)

- Pharmacies registered with the Health Sciences Authority (HSA)

- Optical shops registered with the Accounting and Corporate Regulatory Authority (ACRA)

- Assistive technology device providers registered with the National Council of Social Service (NCSS), MOH or ACRA.

Alternatively, you can check via the Approved Institutions Search.

What happens if we have unused funds in the CDA?

At the end of the 12th year, the CDA will be closed. Any remaining funds in the account will automatically be transferred to his/her Post-Secondary Education Account (PSEA).

Embarking on the parenting journey is a fun experience. That said, there are also practical aspects to family planning that spouses should discuss and work out too. Looking to plan your finances and map out your personal needs to grow your savings and wealth further? I’m just a phone call or text away to share my knowledge and experience as a mother and financial advisor.

Note: This article was updated in February 2023.