As a mum, I know there are so many things that I would like to impart to my children. With my son in school, I tend to leave academic teachings to his teachers because I believe that he is in good hands of experts. But I know that there are some knowledge such as financial literacy and the concept of money that I could introduce to him and what better way than to learn from mummy who has her fingers on financial planning and family budgeting, right?

It sounds like a big idea for little ones, but it need not be. Here are some easy and fun ways to teach kids about money and I hope you find them inspiring and helpful too:

6 Fun Ways To Teach Preschoolers About Money

1: Introduce the idea on how much things cost with real-life experiences

Take a trip to the supermarket or visit an online shop together to show him that different things come with price tags. Share a basic introduction about how much his favourite fruits cost versus a bar of chocolate, for example. At the supermarket’s checkout counter, let your bub hand the cash over. This gives him a real-life experience on how the money exchange process works. If you’re shopping online, explain to him that you need a credit card to pay for your purchases.

2: Use toys to introduce the idea of buying

With some plastic coins or monopoly money, one can start “buying” things in your play pretend store at home. A great way to bond with your kids, this also extends the idea to kids about exchanging money for things, learning to count money and going through the thought process of whether they have enough money to buy something they want and more.

3: Set aside 3 jars: save, spend and give

With 3 separate jars, parents can explain why we need each of them and what their purpose is. So when your child receives some money, she can decide which jar to fill too. The general rule of thumb for savings is 20% of what we earn. While that might be a little tough for the younger ones to understand, slightly older kids can be given a scenario of having $10 and saving $2 from it. How about making your own DIY jars together?

4: Give them opportunities to “earn”

It could be simple tasks such as household chores to allow kiddo to earn some moolah. You will be surprised that earning his keeps can be a pretty empowering feeling for him too. With this cash that he “earns”, remind him of the 3 jars and explain about the save, spend and give concept again and let him keep his money accordingly.

5: Learn to sort coins and notes

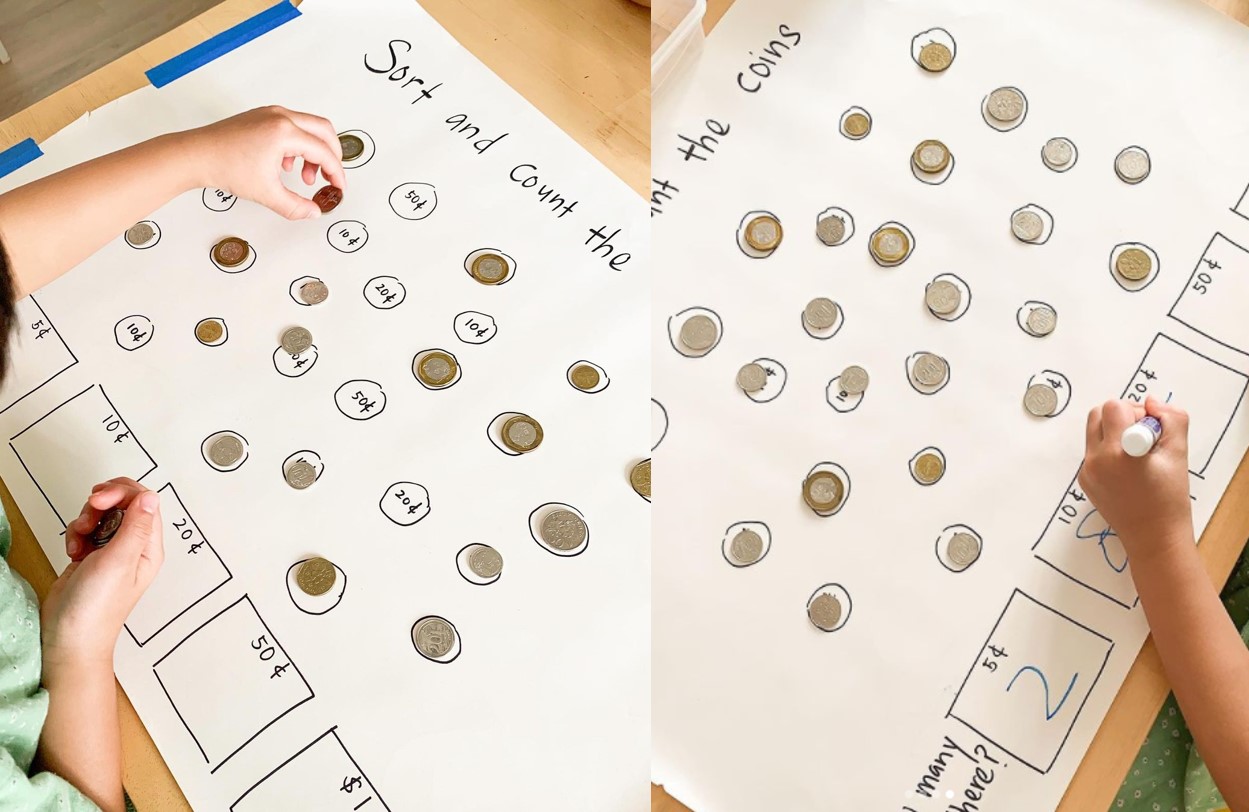

Visual learning and tactile methods are great ways for kids to acquire new knowledge. With a mixture of our Singapore coins or notes (I’d recommend either set first), let your preschooler categorise and group the same ones together.

This low-prep sort and count the coins activity by Happytotshelf helps with coin recognition – her 6yo is learning through play as he prepares for Primary One next year.

6: Learn to count money

Learning to count sounds easy for adults, but it can be challenging for preschoolers to grasp the concept of different coin combinations making up 1-dollar. Start with dollar notes as they learn skip counting with 2-dollar, 5-dollar and 10-dollar notes. Don’t worry, by Primary One, your child should be able to understand about counting money and getting change.

In Singapore, the Ministry of Education define preschoolers as children under 7 years old. Prior to starting primary school which begins in the year they turn 7, most kids attend kindergarten or childcare to learn social skills, build their confidence and develop literacy and numeracy knowledge. These are life skills and part of their developmental milestones too. Afterall, learning how to count money and more is part of primary one preparation too!

Do you have other fun ideas on how to teach kids about money? Share them below too!